Personal finance aggregators are tools that help users manage and track their financial accounts, including bank accounts, credit cards, investments, and loans.

Personal finance aggregators are tools that help users manage and track their financial accounts, including bank accounts, credit cards, investments, and loans.

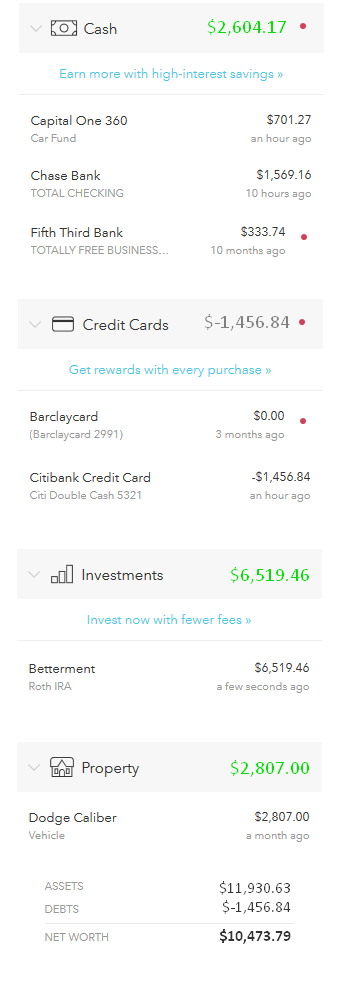

An aggregator is a piece of software that takes data from multiple sources and provides centralized access to it. When it comes to personal finance aggregators, Mint was the original. Although it's been owned by Intuit since 2009 (which also owns QuickBooks and TurboTax), there was nothing like it when it was first created. For the first time, you could automatically pull your personal financial data, from all the financial institutions that you do business with, into one place at the click of a button. Checking and savings accounts, credit cards, investment accounts, a complete financial picture: assets and liabilities, including personal and student loans, credit cards, home mortgage and home equity. You could see your accurate, real-time net worth just by opening the app.

The average person has 15 different financial accounts: checking and savings, credit cards, student loans, investment accounts, and more. To keep your financial future on track, the simplicity of being able to see everything in one place has obvious benefits. However, there are unique challenges to this space that explain why Mint was the undisputed leader for so long.

When comparing personal finance aggregators, there are many key features to consider:

| Mint

| Personal Capital

| YNAB

| Monarch Money

|

Budgeting tools

| Yes

| Yes

| Yes

| Yes

|

Investment tracking

| Yes

| Yes

| No

| No

|

Retirement planning

| No | Yes

| No

| No

|

Bill Reminders

| Yes

| Yes

| Yes

| Yes

|

Credit score monitoring

| No

| Yes

| No

| No

|

Price

| Free

| Free

| $8-$15/mo

| $8-$15/mo

|

| Mint

| Personal Capital

| YNAB | MonarchMoney |

|---|

| Budgeting tools | Yes

| Yes | Yes | Yes |

| Investment tracking | Yes | Yes | No | No |

| Retirement planning | No | Yes | No | No |

| Bill reminders | Yes | Yes | Yes | Yes |

| Credit score monitoring | No | Yes | No | No |

| Fee | Free | Free | Paid | Paid |

Mint is one of the most popular personal finance aggregators, offering a wide range of features such as budgeting tools, investment tracking, and bill reminders. Personal Capital is similar to Mint, but also includes retirement planning and credit score monitoring. YNAB (You Need a Budget) is, focused on budgeting and is a paid service. MonarchMoney is another paid service, but created by the original team that created Mint years ago (before it was sold to Intuit).

In summary, each personal finance aggregator has its own set of features and capabilities, and the right choice for you will depend on your specific financial needs and goals. Mint and Personal Capital are both great options for those who want a comprehensive view of their finances, while YNAB and Monarch are more focused on budgeting. Monarch Money in particular excels at a couples- or family-based approach, allowing each family member access to a shared budget and a shared view of accounts.